Nature loss presents financial risks that must be quantified

- Samantha Youngeun Shin

- Feb 23, 2022

- 3 min read

Updated: Jun 29, 2023

“We can’t meet our climate targets without protecting nature,”

– Emmanuel Macron, January 2021

In his opening remarks at the One Planet Summit last year, French President Emmanuel Marcon underlined the need for disclosure on biodiversity, an idea that led to the Taskforce on Nature-related Financial Disclosures (TNFD), which officially launched in June 2021.

Given that climate change is one of the main causes of natural capital loss, identifying nature-related impacts and dependencies beyond climate-related risks is highly relevant for CCAP’s key stakeholders, including governments and financial institutions.

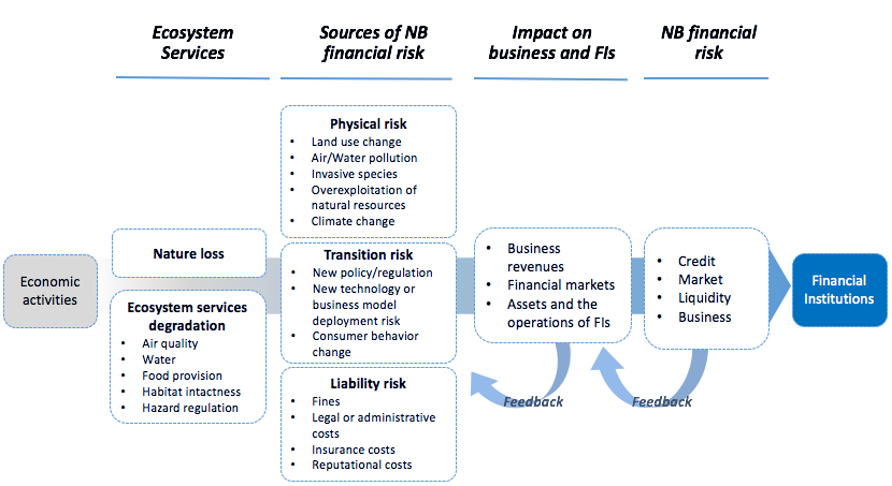

Natural capital is the stock of renewable and non-renewable resources such as plants, animals, soils, minerals, and ecosystems that combine to yield a flow of benefits to people. (Ecosystem services include things like clean air and crop pollination). Nature loss is any decline of natural capital, including of ecosystem services and biodiversity, which can be driven by climate change, invasive species, land use change, overexploitation of natural resources, and pollution. Nature loss leads to a variety of risks – physical, transition, and liability risks – which result in increasing financial risks, including for credit, market, liquidity, and business.

Measuring nature-based risks

Nature-based risks are measured in two ways:

First, we look at Anthropocene impacts (e.g., GHG emissions, pollution) on species and habitats

Then, we consider society’s dependencies on ecosystem services.

Combined, the impacts and dependencies predict overall risk.

Since the 2015 Paris Agreement, the main focus of international organizations and financial institutions when establishing frameworks and/or standards for environmental risk has been limited to climate change mitigation and adaptation (e.g., the Task Force on Climate-related Financial Disclosures, EU Taxonomy). Yet, climate change is a substantial direct driver of nature loss, and other natural loss drivers are further exacerbated by climate change. In order to quantify a comprehensive environmental risk on finance and economy, we must understand why and how nature loss can become a financial risk.

The following diagram shows how nature loss can translate into financial risks.

Figure 1. Nature loss impacts on financial institutions

Source: Author, adapted from "An Introductory Guide to Valuing Ecosystem Services"

Accordingly, collaborative working groups, consisting of financial institutions and international organizations, have launched a number of initiatives for defining nature-related financial risks and developing risk-measuring metrics and thresholds. The informal Working Group consisting of an Informal Technical Expert Group, together with other international organizations such as Global Canopi, UNDP, UNEP FI, and WWF, for instance, are setting the scope of the TNFD. The European Investment Bank partnered with the EU to create the Natural Capital Financing Facility, a financial instrument that supports projects delivering on biodiversity and climate adaptation.

In addition, diverse measurement approaches based on focus area and major measurement objectives have been developed. Among them, the Exploring Natural Capital Opportunities, Risks and Exposure (ENCORE) online platform – developed by Natural Capital Finance Alliance and UN Environment Programme World Conservation Monitoring Centre – has recently released a biodiversity module which allows financial institutions and other users to understand natural capital risks, while facilitating the alignment of investors’ portfolios with global biodiversity goals. As such, collaborative initiatives between public institutions and financial institutions are actively underway to develop common and comprehensive risk measuring tools, methodologies, and frameworks, as well as to scale up financing on nature-based solutions.

Given that the causes and consequences of nature and biodiversity loss are interconnected and are relevant across different sectors and actors, developing metrics to measure and value nature is extremely challenging, especially compared to other environmental objectives such as climate mitigation (which is measured by the relatively straightforward metric tonnes of CO2 equivalent). Further, there is no internationally agreed-upon framework or definition of nature-related assets or projects to date.

Recognition of the need for biodiversity and nature-based impact assessment

Limited nature-related data and the lack of data collection guidance make it difficult for relevant experts and financial institutions to develop methodologies and evaluate risks.

Nevertheless, incorporating a wider range of environmental impacts including biodiversity and ecosystems is vital for policy development and FI’s environmental risk management in the future. Sectoral and regional knowledge exchanges and collaborative efforts will, therefore, be indispensable to understand environmental risks and opportunities in a more comprehensive manner. The second part of the 15th meeting of the Conference of Parties (COP 15) to the Convention on Biodiversity Diversity (CBD) that will be held from April to May of this year will be instrumental in setting common frameworks and standards. The post-2020 global biodiversity framework will be finalized, and the parties will review progress on the CBD’s Strategic Plan for Biodiversity 2011-2020, a ten-year framework for action to safeguard biodiversity.

CCAP looks forward to building on its experience with sustainable finance taxonomies to develop standardized quantifications for biodiversity. CCAP supports the development of nature-based solutions throughout country readiness programs and REDD+.

Comentários